Marriage is the best thing that happens to some people. At the same time, others are not as happy and they will eventually go through a divorce. Sure, this is a painful procedure for both partners, but the situation is much harder on children, don’t you agree? They will fill a negative side of the occurrence much more than their parents.

When two people are about to get divorced, they need to share information about their incomes to establish and determine the line of spousal or child support. Naturally, spousal support is not always crucial. But when children are still young, this is an absolute must. It depends on one of the partner’s income.

Naturally, it can either grow or decline as a result of income increase or decrease. Nevertheless, the divorce itself is a moment when you need to provide exact information about your income to determine the percentage correctly. Now, we would like to provide you with a couple of ways you can verify your income for child support. Let’s check them out.

1. Tax Returns

Probably the best and most widespread way of verifying your income for child support is getting tax returns. The reason why we believe they are the best is that they encompass all the crucial elements from overall income to current income. Also, all the changes that are made in your income will be recorded.

Based on these changes, the child support sum will get higher or lower, as we’ve already stated. Tax returns are universal and you can use them to verify your income for a wide array of different reasons. Child support is just one of those situations. As you can presume, tax returns are made of many documents.

However, the most significant one of them is the 1041 form. We are talking about an official document taxpayers use to file their annual income. It consists of a couple of sections, and each of them focuses on different elements of tour income. The one taxpayers are the most interested in is a refund section.

2. Bank Statements

The next way you can verify your income is to visit your bank and ask for a statement. These statements show the incoming payments both for companies and individuals. When we are talking about small businesses, they can simplify this process by having another bank account that is tied with the company itself.

Basically, we are talking about the applicant’s records of all the transactions, like withdrawals, deposits, and overall balance. The reason why this is an effective method in the case of child support is that the institution that decides on child support needs to have a complete insight before making the final decision.

For instance, they will ask the bank for a couple of months or years of records to have a complete idea about it. Sometimes, it can happen that the applicant is simply not able to pay any sum in the form of child support due to the lack of funds. However, this is determined by the official government institution.

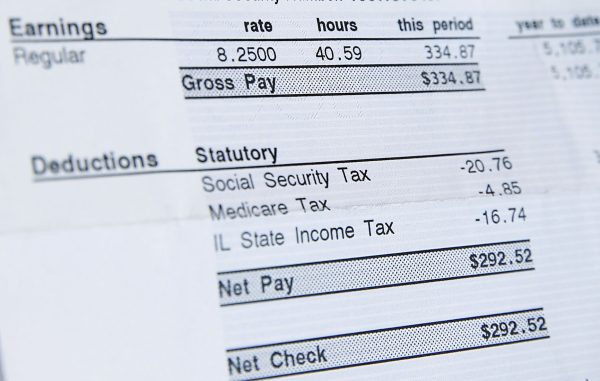

3. Paystubs

A paystub has easily become one of the most popular ways for income verification. The reason is quite simple, it is accessible quite easily, and the user can fill the form on its own. We are talking about the approach that has mainly popular among people who are working remotely and don’t have full-time employment.

By using paystubs, they can provide their income for whatever reason, including the one we have mentioned previously. Since remote workers usually do not have steady working hours, some would think that this method is not as reliable and credible as other ones are. However, we beg to differ.

Naturally, they should be updated frequently. We would say that doing it every month is an absolute must, especially in the case of child support. That way, the official institution can have a grasp of your income and then decide what percentage of it will go to this purpose. That’s why this is a good way to verify your income, without any doubt.

4. Employer Letter

Another way you can do it is to ask the employer for an employer letter. In this letter, the employer will provide crucial information on the employee’s tenure at the company and the income. Both of these elements are crucial when deciding on the percentage of the salary that will go to child support.

Naturally, the same process can be repeated when the applicant changes work position. We would say that this approach is much more efficient in other cases than it is the case with child support. The only problem with this one is that forging it is quite easy, which leaves a lot of space for scams and frauds.

So, all the institutions that get this piece of document, conduct a thorough investigation of the company’s origins. If they find out that the company doesn’t exist, or that the salary amount has been changed to a sum that’s not right, the applicant can find himself in a lot of problems.

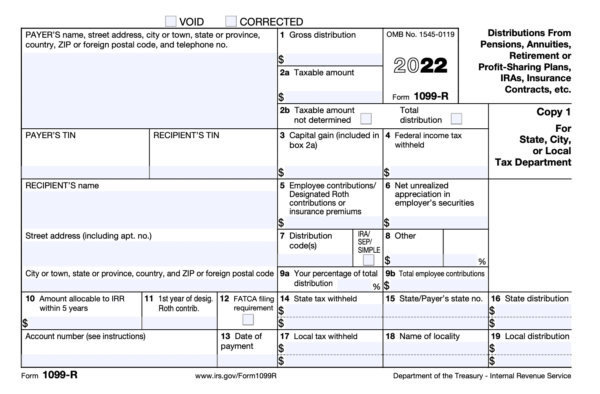

5. 1099 Forms

Last but not least, we would like to mention another approach we believe is great for freelancers and those who work remotely. We’re talking about 1099 forms. The reason why they are used is that they are some sort of alternative to the W2 document, which is characteristic of full-time employment.

Even though this one is not widespread as many others are, that doesn’t mean that you cannot find a proper use for it when needed. In fact, it is recommended by numerous financial experts for its numerous elements that can provide numerous benefits to those who use them to verify their income.

Closing Thoughts

Child support is an important matter, and it is always addressed as the question of the utmost importance. That’s why all the elements need to be done in the smoothest, but also the most controlled way possible. Here, you can find a couple of ways you can verify your income solely for this purpose.